The issue of student loan debt has been a pressing concern for millions of Americans for years. Recognizing the burden it places on individuals and families, President Joe Biden has introduced a series of initiatives aimed at providing relief through student loan forgiveness. In this article, we will delve into the Biden Student Loan Forgiveness Plan, its key components, and how it may impact borrowers.

Understanding the Student Loan Crisis

Before delving into the specifics of President Biden’s plan, it’s essential to grasp the scale of the student loan crisis in the United States. As of my last knowledge update in September 2021, the total student loan debt surpassed $1.7 trillion, affecting over 44 million borrowers. This massive debt burden has far-reaching implications, from delaying major life milestones such as buying a home or starting a family to affecting mental health due to financial stress.

Determining whether your student loans will be forgiven depends on several factors, including the type of loans you have, your repayment plan, and your specific circumstances. As of my last knowledge update in September 2021, here are some common forgiveness programs and eligibility criteria to consider:

Public Service Loan Forgiveness (PSLF)

- Eligibility: To qualify for PSLF, you need to work full-time for a qualifying public service or non-profit organization while making 120 qualifying payments (typically over 10 years).

- Loan Types: Federal Direct Loans (including Direct Consolidation Loans) are eligible. Other federal loans, such as FFEL and Perkins loans, are not eligible but can become eligible if consolidated into a Direct Consolidation Loan.

- Verification: To ensure you’re on track for PSLF, submit the Employment Certification Form (ECF) annually and maintain eligible employment

- Eligibility: Borrowers on IDR plans, such as Income-Based Repayment (IBR), Pay-as-you-earn (PAYE), and Revised Pay As You Earn (REPAYE), can have any remaining loan balance forgiven after making payments for 20 or 25 years, depending on the specific plan.

- Loan Types: Federal Direct Loans are eligible.

- False Certification Discharge:

- Eligibility: If your school falsely certified your eligibility for federal student aid, you may be eligible for loan discharge.

- It’s important to note that forgiveness programs can change over time, and eligibility criteria may evolve. Additionally, the status of student loan forgiveness programs may change based on legislative or administrative actions.

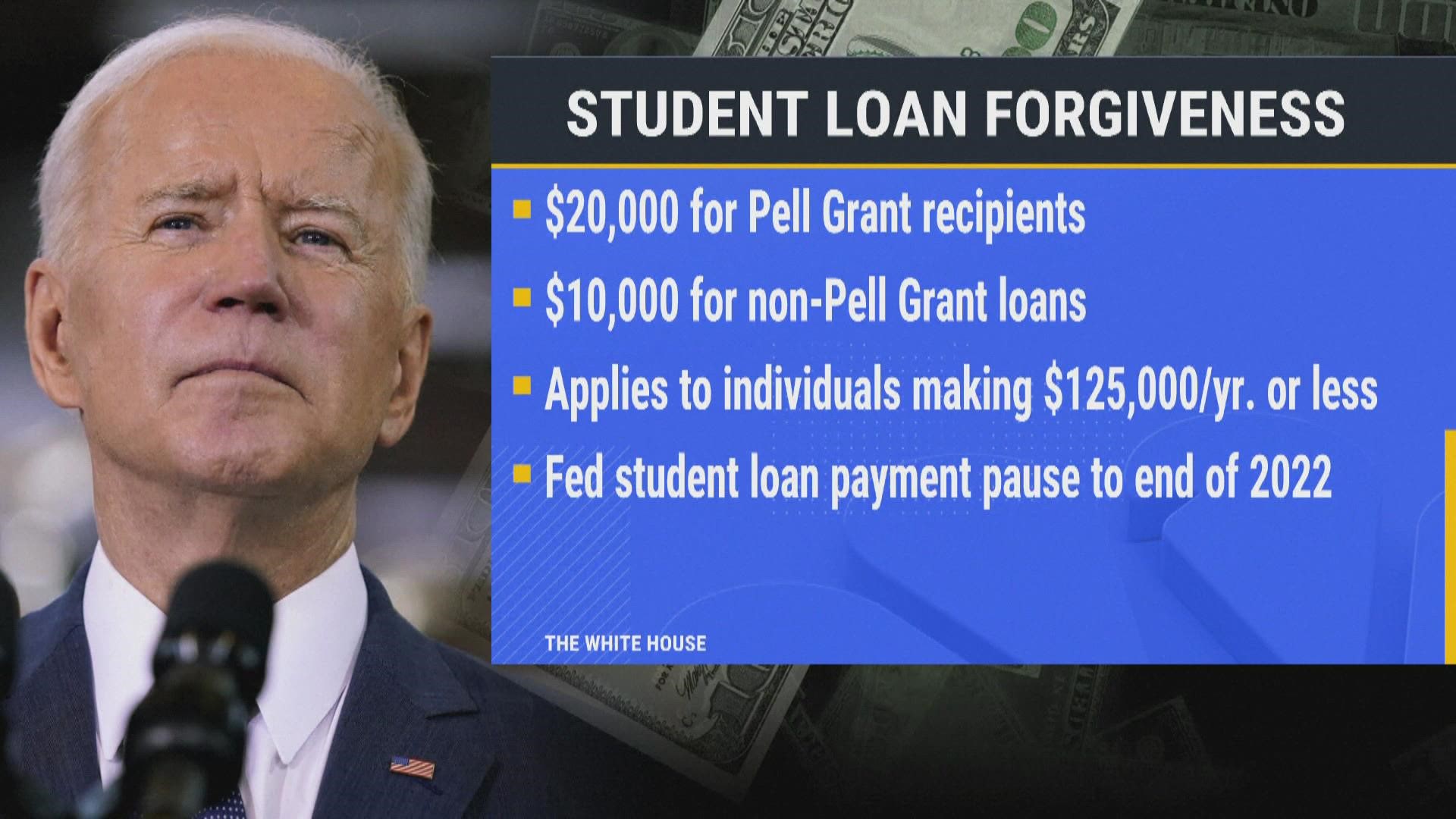

The Biden Student Loan Forgiveness Plan

President Biden’s approach to addressing the student loan crisis involves several key components and proposals:

1. Income-Driven Repayment Plans

One of the cornerstones of the Biden plan is to expand income-driven repayment plans. Under these plans, borrowers’ monthly payments are capped at a percentage of their discretionary income. Additionally, for those with lower incomes, the remaining balance can be forgiven after a certain number of years of consistent payments.

2. Public Service Loan Forgiveness (PSLF) Enhancement

The Biden administration aims to simplify and expand the Public Service Loan Forgiveness (PSLF) program. This program forgives the remaining student loan balance for borrowers working in public service or non-profit jobs after making 120 qualifying payments. The proposed changes seek to make the program more accessible and inclusive.

3. $10,000 in Broad Student Loan Forgiveness

President Biden has expressed support for providing $10,000 in broad student loan forgiveness to all borrowers. However, this proposal has faced debates and challenges in Congress, with differing opinions on the extent of forgiveness.

4. Free Community College and Increased Pell Grants

The Biden plan also includes initiatives to make community college tuition-free for eligible students and increase the maximum Pell Grant award. These measures aim to reduce the need for borrowing in the first place.

5. Streamlining Bankruptcy Discharge of Student Loans

Another aspect of the plan is to make it easier for borrowers to discharge their student loans through bankruptcy. Currently, student loans are challenging to discharge in bankruptcy court, but this proposal could make it more accessible for those facing extreme financial hardship.

Conclusion

The Biden Student Loan Forgiveness Plan represents a comprehensive effort to address the student loan crisis in the United States. While these proposals have the potential to provide much-needed relief to borrowers, it’s important to note that they are subject to legislative approval and may undergo changes during the policymaking process.

As a borrower, staying informed about these developments and understanding the options available to you is crucial. Whether you’re exploring income-driven repayment plans, considering public service as a career path, or hoping for broad forgiveness, it’s advisable to consult with a financial advisor or student loan expert to navigate the complex landscape,